RESPONSIBLE BUSINESS | Kogta Financial [April 2023]

RESPONSIBLE LENDING

KFL integrates ESG criteria into its operations and financing decisions for screening the material ESG risks and opportunities of every product offered. This ensures that our services and operations are sustainable from an environmental, social, and financial perspective. The integration of ESG into our financing decisions starts from due diligence through the credit phase.

Our products are subject to ESG due diligence, which involves screening for potential ESG risks and ensuring ESG compliance. Each proposal undergoes a quantitative assessment through an ESG checklist and has to achieve a minimum ESG risk score to proceed further. Proposals not meeting the minimum required ESG risk score go through another high-level screening by senior management. KFL adheres to the ADB: Asian Development Bank prohibited investment activities list and the International Finance Corporation (IFC) Performance Standards on Social & Environmental Sustainability and strictly avoids doing business with any excluded entity. During the screening or diligence process, if material risks are identified, the borrower must develop an action plan to mitigate these risks or monitor ongoing progress on ESG aspects, as appropriate. We also obtain a declaration from our borrowers and vendors confirming compliance with our transparent and non-discriminatory ESG commitments outlined in our ESG policy.

Key ESG concerns that get checked during ESG due diligence are listed below:

ENVIRONMENT

- Activities causing Environmental pollution (Air Pollution, Water Pollution, Noise Pollution)

- Usage of high carbon intensive machinery/vehicles

- Activities in Ecological/Ecosensitive zones

- Activities causing short-term and/or long-term ecological disturbances

SOCIAL

- Use of loan funds in illegal activities

- Opposition from any stakeholder being detrimental to the viability of the project

- Direct or indirect involuntary dislocation or displacement or resettlement of people

- Breach of fair employment and inclusion & diversity principles

- Non-payment of legal minimum wages

- Employment of child or forced labour

- Lack of safe and healthy working conditions for employees

- Any other specific occupational health & safety related risks and vulnerability

GOVERNANCE

- Absence of requisite approvals/licenses wherever needed

- Non-compliance to local authority norms/National or State laws and regulations

- Business owner or partner’s involvement in criminal activities or any criminal convictions against them

PROVIDING OUR CUSTOMERS ACCESS TO FINANCE

KFL is committed to achieving financial inclusion by enhancing digital literacy and financial inclusion initiatives to support underprivileged communities. We aim to promote accessible and affordable products, essential tools for managing financial risks, and support financial literacy programmes and education initiatives to help people make informed financial decisions.

The Company has developed products and services to provide low-income, self-employed, and informally employed individuals with the financial support they need to achieve their goals. These products are customised to cater to customers’ specific requirements based on their sector, development, and geographic location. We focus on vehicle and MSME lending to meet the demand for unaddressed debt and enable greater financial access for underserved communities.

The majority of our customers are individuals who are either low-income, self-employed, or informally employed. We rely on technical support and interpersonal interactions to provide our customers with faster and more efficient services while maintaining a personal touch. Our financial inclusion branch network comprises 200+ branches and currently serves customers across 8 states and 2 UT’s as of March 31, 2023. We have a dedicated team that collects customer feedback and addresses grievances promptly and effectively. To facilitate this, we have established a structured grievance redressal framework supported by a review mechanism. Customers can use this framework if they have any queries or concerns or require clarification relating to our products. We continually update our products and business operations by incorporating customer feedback and ensuring high product and service quality standards. By doing so, we aim to provide our customers a seamless experience and promote financial inclusion for underprivileged communities.

FINANCIAL LITERACY

We understand that financial literacy is crucial to an individual’s long-term financial success, and the lack of it can be detrimental. Therefore, we strive to bridge this gap by leveraging our social media platforms to share infographics in vernacular language to present financial awareness information quickly and clearly.

Our social media posts focus on critical financial skills and concepts, aiming to make our society less vulnerable to financial fraud and encourage smarter financial decision-making. Additionally, our website has a dedicated page where we share blogs in simple language and easy-to-understand terminologies on various finance-related topics. These topics include personal finance, small business loans, loan schemes, CIBIL score, and sound financial habits to manage business growth better.

Educating our customers on financial literacy will empower them to make informed financial decisions and help them achieve their financial goals. Our goal is to provide our customers with the necessary tools and knowledge to improve their financial well-being and create a more financially inclusive society

DATA PROTECTION AND CYBER SECURITY

Data protection and information security are critical aspects of protecting sensitive information in today’s digital age. Data protection is concerned with safeguarding the personally identifiable information (PII) of customers, such as financial information, property documents, KYC, and contact information. Data protection applies to all sensitive information that organisations handle, including that of customers, employees, and shareholders. By implementing data privacy measures, sensitive data is only accessible to authorised parties and prevents unauthorised access by malicious individuals.

We have implemented a well-defined governance structure to ensure the security of information and data protection. This includes establishing an Information Technology Strategy Committee, a Board-approved Information Technology Policy, and a Board-level Risk Management Committee. The Company also follows Cert-in & ReBIT advisories to protect against global cybersecurity threats. Cybersecurity has become a critical component for KFL as organisations are expected to safeguard sensitive data and protect against cyber threats. An effective cybersecurity policy involves conducting regular risk assessments, implementing strong access controls and authentication measures, and having a clear incident response plan. We have formed an internal team to monitor Cyber Risks, which continuously monitors network traffic and events to detect any suspicious activities and respond promptly to potential incidents. The Company also subscribes to various threat intelligence services that assist in identifying malicious indicators of compromise (IOCs) and blocking them proactively to prevent potential attacks.

In the reporting period, there were zero incidents of data breaches with the help of above initiatives.

EMPLOYEE ENGAGEMENT

KFL has always prioritised establishing a work culture that each employee is proud of. Our employees are the most important drivers of our business, and we prioritise creating a prejudice-free work environment that focusses on their overall professional development. We understand that employee engagement is a key driver to enhancing motivation, productivity, and overall employee satisfaction. We engage our employees in various events throughout the year. All employees are encouraged to participate in the weekly event “Shaandaar Shaniwaar” which includes games and entertaining events that allow employees to unwind and reveal their hidden skills. Cricket tournaments such as the “ Kogta Box Cricket League” are also organised annually as a teambuilding activity to help people bond better and the teams are formed in a gender-neutral format to ensure equal participation.

Employees also have the opportunity to communicate with senior leadership during regular review meetings. All employees receive recognition for successfully fulfilling major organisational tenure milestones. We also plan to carry out an employee satisfaction survey in coming months for better understanding the requirements of our employees at the workplace.

LEARNING & DEVELOPMENT

Learning and Development (L&D) enhances an individual’s knowledge, skills, and capabilities through mutiple training programmes. It is a strategic approach to improve employee performance, increasing productivity, and achieving business objectives. At KFL, employee professional growth and development is one of our core priorities. We facilitate rapid advancement for our workforce by encouraging them to take managerial positions. We aim to create pathways for our high-performing employees with behavioural competencies and potential for leadership roles. As a result, we build a pool of future-ready leaders and minimise the turnaround time and investment required for training new hires in the same role.

In the reporting period, we offered both online and in-person training sessions, with a total of 3,032 employees participating, and a total of 14,835 training man hours. Apart from this, 1,165 employees receive refresher training on ESG awareness

EMPLOYEE RETENTION PROGRAMS

We understand the importance of our employees and value their association with us. In such dynamic scenarios, employees do come across situations where they feel stressed and unmotivated leading to employee attrition. To cater the needs of such employees, we have special programs:

- Re-energise Program: A special training program for existing employees with low performance, in an effort to boost productivity, enthusiasm and recognise rising performers.

- Revive – Second Innings: A specialised training programme that supports and guides underperformers to assist them in growing and retain them in the system. This is a special motivational session held for underachievers to improve their performance and assist emerging from the underachievers pool.

FAIR PERFORMANCE MANAGEMENT, RECOGNITION AND REWARDS

We have designed our HR policies to recognise individual performance and reward employees’ efforts. Throughout the reporting period, employees get a regular performance & career development review as well as a performance assessment. Employees are motivated and shown that their efforts are valued through incentive and recognition programmes.

We have designed our HR policies to recognise individual performance and reward employees’ efforts. Throughout the reporting period, employees get a regular performance & career development review as well as a performance assessment. Employees are motivated and shown that their efforts are valued through incentive and recognition programmes.

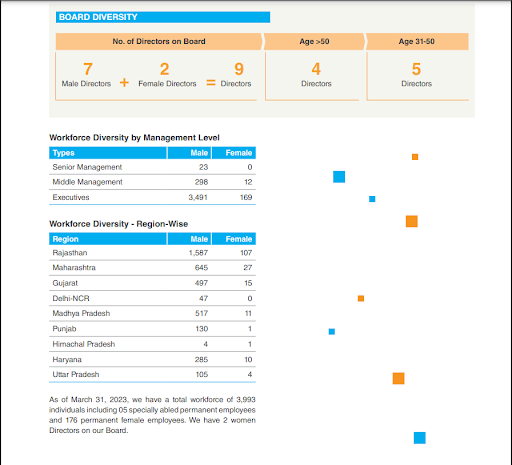

DIVERSITY & INCLUSION

We strongly emphasise diversity and inclusion at workplace. One of our primary hiring policies is to ensure that we hire local talent in all of our branches and that there is no discretion or bias based on any social factors such as gender, age, caste, religion, region, or nationality. We have also been able to significantly raise the proportion of female employees in our organisation over the years and will continue to do so in the near future. We strive tirelessly to help women in our workplace and offer them a flexible environment to maintain their work-life balance. We are an equal opportunity company with a diverse employees representing a wide range of backgrounds and life experiences.