25 years of Strengthening our Strategic Advantages

Over the years, Kogta Financial has been fine-tuning its client interface, operations, products and processes to enhance its performance on various parameters and deliver benefits to all its stakeholders. Some of the key elements of our strategy, which have fortified our presence and position include:

UNIQUE LENDING MODEL

Digital lending system based on appropriate risk pricing to deliver superior turnover time, increased productivity and deeper customer insights

TECH-ENABLED

In-house integrated technology and portfolio management system for stringent internal controls, seamless product offerings and efficient customer service

DIVERSE PRODUCT PORTFOLIO

Catering to a large MSME and underserved customer segments with diverse credit needs for delivering high yield at low risk.

ROBUST CREDIT AND RISK MANAGEMENT FRAMEWORK

To leverage our risk-based lending model to customise pricing the risk price based on borrower’s profile and the product features

STRATEGIC LEADERSHIP TEAM

Experienced management and qualified leadership team to guide the company in fulfilling its mission, vision and broader objectives

HOLISTIC GROWTH

Strategic growth by penetrating new markets after a thorough evaluation of evolving local customer needs for credit

HEALTHY LIQUIDITY

Raising funds from reputed based private equity investors and a broad base mix of lenders helps maintain a strong liquidity profile

Powering Mobility, Sharing Prosperity

It’s been 25 years since we set out on this long and fulfilling journey…

Armed with a vision to power mobility and spread prosperity, a team of dynamic entrepreneurs – Shri Banwari Lal Kogta, Shri Bal Mukund Kogta and Shri Radha Krishan Kogta – founded Kogta Financial. Over the years, the NBFC sector grew steadily; And the Company’s growth more than matched it. The sector saw good times and faced crises; Through it all, Kogta Financial continued to expand in terms of clientele, geography and AUM.

Two and a half decades later, Kogta Financial has come a long way. Today, we have…

…powered the dreams of millions in rural and semi-urban towns. …

a significant presence across north, west and central India. …adopted digital technology to drive greater efficiency in operations and customer convenience.

We are striding forward on the foundations of dedicated customer service, fair business practices and efficient, safe and trusted financial policies. Our delighted customers have been coming back to us, time and again, for their lifecycle credit needs. While powering mobility with vehicle loans, we’re proud to have played a role in powering their business and individual growth and upward mobility too. And as we’ve grown, we have been sharing prosperity with…

…our clients/borrowers, enabling them to improve their lifestyles. …our employees, by ensuring career progression and professional growth, over the years.

…our shareholders, in the form of value creation. In our clients’/stakeholders’ prosperity, we see our success.

25 years later, we are steered by next-generation, meritocratic leaders and the future looks exciting. It is our dream to continue to serve the needs of our clients to expand our client base on the strength of our reputation, service, products and processes to grow into a leading player in the sector, driven by our strong management and the backing of investors.

We’ve enjoyed the 25-year dynamic and rewarding journey this far. But we believe that the best is yet to come…

Celebrating 25 years and counting

We aim to create a more financially inclusive ecosystem in India by catering to the credit needs of the large and underserved segments of individuals and MSMEs. Our clientele include farmers, first-time borrowers, small entrepreneurs, businesses, retail traders and other underserved categories who seek to tap into the formal financial sector.

Our diverse asset finance offerings include Cars, Commercial Vehicles, Tractors, Construction Equipment & Loan against Property/MSME Loans.

Our NBFC enterprise journey began in our home state – Rajasthan and over time, we have built up a network of 200+ branches across Gujarat, Maharashtra, Delhi NCR, Madhya Pradesh, Uttar Pradesh, Punjab, Haryana, and Himachal Pradesh.

We have an integrated technology platform for loan origination and in-house portfolio management system uses real-time data to cover enterprise-wide functions for efficient customer servicing.

Supported by 4,000+ dedicated employees, fair and facilitating business practices, and structured and trustworthy financial policies, we serve 1,00,000+ customers with uncompromised customer service.

Kogta Financial (India) Limited is a Jaipurbased Non-Banking Financial Company (NBFC) in the 25th year of operations, with a strong presence in the asset finance business.

Our focus to strengthen the retail and SME/MSME segments is backed by a highly secured retail lending mechanism, our stronghold in rising markets, dynamic IT infrastructure, efficient collection processes and a strategic leadership team.

In our 25th year of operations, we remain committed to building a unique financial institution in livelihood and small entrepreneur financing for clients across India. We envisage playing a larger role in increasing the NBFC sector lending in India and contribute to the country’s socio-economic growth in the coming years.

Marking Milestones on our 25th Anniversary

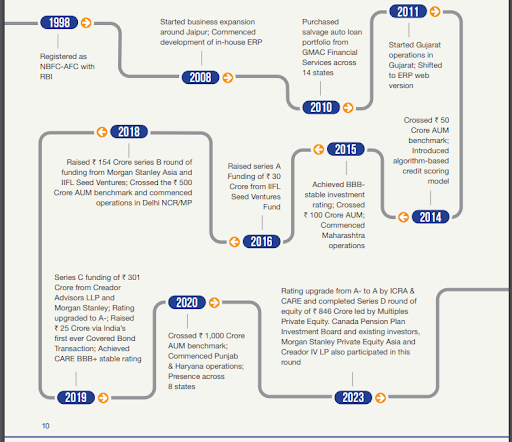

As we foray into the 25th year of operations, we feel a sense of satisfaction as we look back at our journey, calibrated with significant milestones.