Management Discussion and Analysis

ECONOMIC OVERVIEW

Global Economy

According to the World Bank’s Global Economic Prospects report – April 2023, the global economy appears poised for a gradual recovery from the powerful blows of the pandemic and of Russia’s unprovoked war on Ukraine. Supply-chain disruptions are unwinding, while the dislocations to energy and food markets caused by the war are receding. Simultaneously, the massive and synchronous tightening of monetary policy by most central banks should start to bear fruit, with inflation moving back toward its targets.

During 2022, after years of easy money policies, central banks across the world hiked interest rates, amid the highly uncertain global environment. Inflation reached record levels in some developed countries and the monetary tightening that followed resulted in risks to financial stability. As the year drew to a close, global inflation showed signs of decreasing, although more slowly than initially anticipated. The World Bank report expects inflation to decline from 8.7% in 2022 to 7.0% this year and 4.9% in 2024. It projects that the global growth will bottom out at 2.8% this year before rising modestly to 3.0% in 2024.

The World Bank cautions that with the fragile economic conditions, any new adverse development – such as higherthan-expected inflation, abrupt rises in interest rates to contain it, a resurgence of the COVID-19 pandemic, or escalating geopolitical tensions – could push the global economy into recession. However, countries and their policy makers seem committed to avoid a recession.

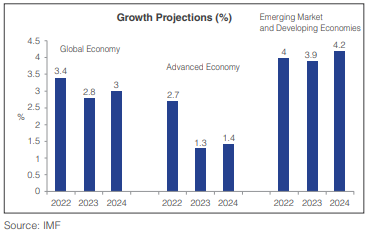

The International Monetary Fund’s projections, laid out in the World Economic Outlook (WEO) Update – January 2023 are more optimistic. It projects that global growth will fall to 2.9% in 2023 but rise to 3.1% in 2024. In fact, the 2023 forecast is marginally higher than predicted in the October 2022 World Economic Outlook.

The IMF attributes the drag on global economic activity to rising interest rates and the war in Ukraine.

The IMF suggests, in its WEO – April 2023, that policymakers have a narrow path to walk to improve prospects and minimise risks. Central banks need to remain steady with their tighter anti-inflation stance, but also be ready to adjust and use their full set of policy instruments – including to address financial stability concerns – as developments demand. Fiscal policymakers should buttress monetary and financial policymakers’ actions in getting inflation back to target while maintaining financial stability.

Indian Economy

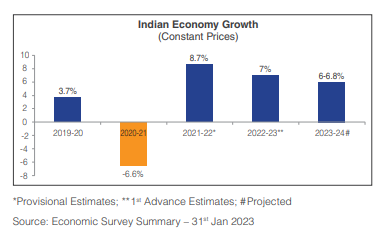

After posting a growth of 8.7% in FY 2021-22, which was largely a function of the base effect, the economy is expected to grow at a robust 7% (in real terms) for the year ending March 2023, according to the Economic Survey – 2023.

According to policymakers, the Indian economy recovered well from COVID-19 using financially sustainable measures and a lot of reforms were carried out under the pandemic stress. The hiatus triggered by the pandemic also gave India the opportunity to explore decoupling, to an extent, from the global economy; this was another factor that contributed to pre-empting a contagion-led recession. Another significant factor was that India has a vast number of small enterprises and self-employed professionals. These entities contributed to intermediary demand as well as a sustainable recovery, making India more resilient to the international slowdown.

According to the Economic Survey, India’s economic growth in FY 2022-23 has been principally led by private consumption and capital formation and they have helped generate employment as seen in the declining urban unemployment rate and in the faster net registration in Employee Provident Fund. Moreover, World’s secondlargest vaccination drive involving more than 2 billion doses also served to lift consumer sentiments that may prolong the rebound in consumption.

According to the IMF, India has overtaken the UK to become the world’s fifth-largest economy with a GDP of US$ 3.53 trillion in CY2022 and is now behind only the US, China, Japan and Germany. The Economic Survey highlighted the emergence of positive trends, like the rebound of private consumption, which in turn will boost production activity and drive higher Capital Expenditure (Capex). The robust recovery in the service industry is also visible in people spending on contact-based services, such as restaurants, hotels, shopping malls, and cinemas, as well as the return of migrant workers to cities to work in construction sites.

All this has led to a considerable decline in housing market inventory and stronger corporate balance sheets. Better capitalisation of public sector banks has resulted in an increase in the credit supply and better credit flows to MSMEs.

The Economic Survey summarised the upside to India’s growth outlook as arising from (i) limited health and economic fallouts for the rest of the world from the latest surge in COVID-19 infections in China, and therefore, continued normalisation of supply chains; (ii) inflationary impulses from the reopening of China’s economy turning out to be neither significant nor persistent; (iii) recessionary tendencies in major Advanced Economies (AEs) triggering a cessation of monetary tightening and a return of capital flows to India amidst a stable domestic inflation rate below 6%; and lastly (iv) an improvement in sentiment which provides further impetus to private sector investment.

Outlook

The Survey notes with optimism that the Indian economy appears to have moved on after its encounter with the pandemic, staging a full recovery in FY 2021-22 ahead of many nations and positioning itself to ascend to the prepandemic growth path in FY 2022-23. Yet in the current year, India has also faced the challenge of reining in inflation that the European strife accentuated. Measures taken by the government and RBI, along with the easing of global commodity prices, have finally managed to bring retail inflation below the RBI upper tolerance target in November 2022.

The economy has also benefited from the timely and proactive intervention of the RBI, which has been undertaking a cautious approach in its MPC actions. In its April 2023 MPC meet, the committee projected faster growth and softer inflation this year.

While the RBI kept the policy repo rate unchanged at 6.50% and other policy rates were also kept unchanged in its April 2023 MPC, however, it declared a readiness to act if the situation so warrants. It projected that India’s real GDP growth for 2022-23 is estimated at 7.0%. Private consumption and public investment were the primary drivers of growth. Economic activity remained robust in Q4, with a 6.2% expected increase in rabi foodgrains production for 2022- 23. Industrial production and services sector indicators also showed healthy growth.

Source: https://pib.gov.in/PressReleasePage.aspx?PRID=1894932