APPROACH TO SUSTAINABILITY | Kogta Financial [April 2023]

BRIEF OUTLINE ABOUT THE REPORT

Kogta Financial (India) Limited (KFL) believes that environmentally and socially responsible businesses are the foundation of a sustainable and inclusive society. This is the first communication of the organisation to our stakeholders with a clear perspective on our ESG philosophy, approach, and commitments. Through this report, we aim to share our commitment and performance related to ESG strategies and being transparent with various stakeholders, including employees, investors, customers, business partners, suppliers, community, and government.

ESG Vision

To ensure our services and operations are sustainable from environmental, social and financial perspective.

ESG Approach

At KFL, we always consider ESG at the forefront and hence we constantly benchmark our environmental, social, and governance practices against global standards and make substantial efforts to create more value for our stakeholders

Our ESG strategy is based on a strong commitment to benefit society, our customers, employees, shareholders, communities, and all other stakeholders in responsible and sustainable manner. We are evaluating every aspect of our organisation to put procedures, tools, and resources in place to monitor, manage, and improve all material ESG parameters. This will aid in developing resilience and longterm value throughout our activities, from more efficient operations to unlocking growth potential in the developing market situation. To reinforce our ESG commitment, we formally devised a dedicated ESG Policy in the year 2020, which is driven by our vision to become a “Trusted and Innovative” Financial Service Provider in India.

Feedback KFL values the feedback of the stakeholders and effectively uses the same to improve policies, processes, performance, and disclosures. For questions regarding the report or its contents contact Email: esg@kogta.in

ESG Governance and Management

Our dedication to sustainability demands that we continue to have dynamic, committed, and visionary leadership. Our effective, sustainable governance system controls goalsetting and reporting processes, encourages relationships with internal and external stakeholders, and maintains overall accountability to help us implement our vision across our operations.

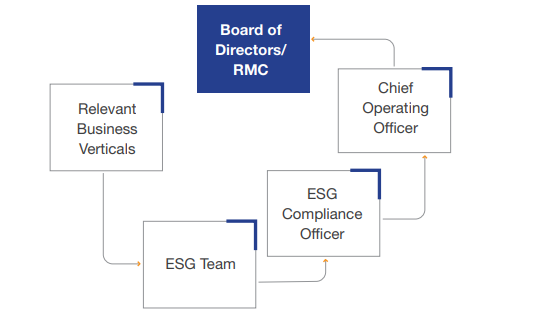

For efficient management and execution of the sustainability initiatives, we have established a governance structure as given below:

The COO oversees and gives final approval to all ESG-related matters and is responsible for implementation. He also reports to the Board and is responsible for managing ESG issues. The COO receives reports from the ESG compliance officer on all matters pertaining to ESG performance and updates. To manage and carry out ESG plans and strategies, the ESG compliance officer works closely with key business divisions.

The Company also has a dedicated ESG team, with cross-functional members, which serves as an enabler for our continuous commitment to the environmental, social, and governance parameters, including the underlying topics such as corporate governance, stakeholder engagement, responsible lending, health and safety, diversity and inclusion, corporate social responsibility, human capital development, and other material aspects. The team monitors comprehensive data on Company’s operations and meets periodically to track progress and launch new ESG initiatives as a responsible business and a corporate citizen.

STAKEHOLDER ENGAGEMENT PLAN

The Company is committed to engaging with all its stakeholders to understand their perspectives and concerns to craft strategies and policies to deliver long-term value. Constructive communication with internal and external stakeholders is an important exercise that helps us with valuable insights to shape our priorities and strategy concerning our ESG commitment and growth plans. This engagement plan defines the process to identify our stakeholders and their expectations and shall be continually updated to meet the same.

| Stakeholder types | Stakeholder Expectation | Communication channels |

| Investors/ Shareholders (Financial capital providers for the business operation) |

|

|

| Customers (Key drivers influencing the business operations and end user of the product and services) |

|

|

| Employees (Pillars of the company for achieving its strategic vision, mission, goals and enhance the service excellence) |

|

|

| Communities (Drive force for the CSR engagements and enriching lives with mutual beneficial relationship) |

|

|

| Suppliers/Vendor (Resource providers for the business activities) |

|

|

| Media (Important communication platform to identify common interests, express and share opinions and demands, organise, and coordinate interventions) |

|

|

| Government and Regulators (Enforce laws that have an impact on our operations and longterm business goals) |

|

|

In the current scenario, we understand that an effective engagement with all the stakeholders is very important and communication is the only key to achieve it, therefore to address the growing expectations and grievances of the stakeholders we have established an internal Stakeholder Relationship Committee that provides effective oversight in matters related to stakeholder engagement.

The details of Stakeholder Relationship Committee and various Committees is described in the Corporate Governance Section forming part as Annexure-4 of this Board’s Report.

ESG MATERIALITY ASSESSMENT

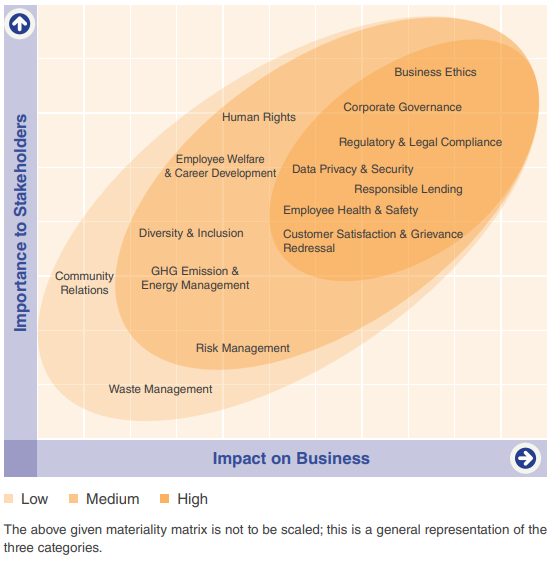

Materiality in ESG is a standardised approach to identify and prioritise the material ESG issues resulting from organisation’s significant impact on the economy, environment, and society.

The methodology adopted by the organisation for the identification of the material topics includes peer and sectoral analysis and internal stakeholder discussions. Based on above exercise, we have identified relevant ESG factors which are material to our stakeholders and business operations.

As an outcome of this exercise, the topics are then further consulted along with executive members to finalise and prioritise material risk and opportunities arising from the business strategy. Finally, a materiality matrix is plotted to represent the identified material factors which are bucketed as low, medium, and high priority. Some of the identified material topics that have potential impacts on business performance have been discussed in this report.

Material Topics

CORPORATE GOVERNANCE

The Board of Directors are the highest governing body engaged throughout the year to deliver governance practices of the highest standards and review the policies and frameworks for the organisation to maintain a robust structure. The Board is focussed on the long-term vision and corporate policy decisions through relevant information provided by the Management and plays a critical role in steering the Company’s strategy.

Our Policies

At KFL, we have designed various policies to promote transparency with a strong focus on disclosures and ethical practices across our various departments. These policies have been implemented to ensure that our stakeholders have access to accurate and reliable information about our operations and decision-making processes. We believe that transparency is key to building trust and maintaining strong relationships with our customers, employees, shareholders, and the wider community.

The infographics below represent policies/mechanisms that are aligned with the Company’s Environment, Social and Governance pillars. Our policies can be viewed at https://www. kogta.in/investor/policy/

(The details on Corporate Governance is described in the Corporate Governance Section forming part as Annexure-4 of this Board’s Report.)

ENVIRONMENT

- ESG Policy

- Environment Policy*

- Waste Management Policy

SOCIAL

- Information Technology Policy

- Privacy Policy for website use (Part of IT Policy)

- Loan and Credit Policy

- Fair Practices Code

- Human Resource Policy

- Corporate Social

- Responsibility (CSR) Policy

- Procurement Policy*

- Employee Health & Safety Policy*

- Prevention of Sexual Harassment at Workplace Policy

- On-Site Emergency Policy*

GOVERNANCE

- Code of Conduct and Ethics

- Code of Responsible Investing*

- Risk Management Policy

- Business Continuity Policy (Disaster Recovery Policy is part of Business Continuity Policy) Policy document on Know Your Customer norms and Anti Money Laundering (AML) measures

- Anti Bribery and Anti Corruption Policy

- Whistle Blower and Vigil Mechanism Policy

- Related Party Transactions Policy

- Code of Practices and Procedures for Fair Disclosure of UPSI

- Internal Guidelines on Corporate Governance

- Stakeholder Engagement Plan*