Management Discussion and Analysis (FY 2023-24)

ECONOMIC OVERVIEW

Global Economy

During CY 2023, the global economy demonstrated a resilient recovery from stubborn inflation, rising interest rates and the climate change crisis. Geopolitical tensions such as between Russia & Ukraine have resulted in grain shortages and an increase in oil and commodity prices resulting in higher inflation. The Israel-Hamas conflict also added to geopolitical tensions and trade disruptions in the global economy. Despite such headwinds, disinflation and steady economic growth with relatively balanced risks, the probability of an economic downturn has reduced during CY 2023.

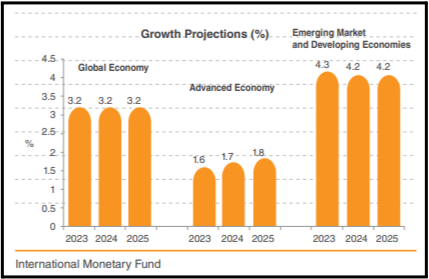

According to the World Economic Outlook Update – April 2024, the projected growth of 3.2% in CY 2024 is attributed to the betterthan-expected resilience displayed across the United States and key emerging markets and developed economies and fiscal support from China. Inflation is declining at a faster rate compared to the peak achieved in 2022 backed by favourable supply-side conditions. Additionally, tighter monetary policies and higher interest rates maintained by the Central Bank have brought down inflation to an average of 5.8% in 2023 from 6.8% in 2022.

During CY 2023, global trade has showcased contraction which was led by the underperformance of exports from developing countries, reduced demand in developed nations, sluggish performance in East Asian economies, and a decline in commodity prices. In the March 2024 World Bank report, the global economy’s trade rebounded in January 2024, with goods trade up 0.4% on a Y-o-Y basis. This marks the first expansion after nine months of contraction. Furthermore, the improvement in the goods component of the new export orders PMI indicates that the decline in goods trade may have bottomed out.

Outlook

Global growth is projected at 3.2% in 2025, which is still below the pre-pandemic level of 3.8%. Inflation is expected to ease down to 5.9% in 2024 and 4.5% in 2025, with the 2025 forecast revised down. With inflation easing, market expectations that future policy rates will decline have contributed to a reduction in longer-term interest rates and rising equity markets. Other factors contributing to the growth are the rapid economic recovery in China and accelerated progress in implementing supply-side reforms. On the downside risk global economy needs to remain cautious towards geopolitical tensions as the conflict in the Middle East has increased the supply chain disruption and the shipping costs in the Red Sea. However, with faster disinflation and steady growth, the possibility of a severe economic downturn has diminished and the global economy will maintain steady growth in the near future.

Indian Economy

India’s economic journey in FY 2023-24 stands as a testament to determination and resilience, as it overcame the obstacles of global volatility to sustain growth momentum and solidify its place as the world’s fifth-largest economy. According to the latest NSO press release, the Indian economy remained steadfast with a robust GDP growth rate of 7.6% in FY 2023- 24 compared to 7% growth in FY 2022-23. This growth is driven by several factors, including capital spending by the government, strong manufacturing activity, robust domestic demand, increased capital investment, and improved efficiency & transparency due to government support and structural reforms such as the Goods and Services Tax and Insolvency and Bankruptcy Code.

Core Industries and Sector Performance

The output of core industries experienced a substantial increase, rising by 8.6% during Apr-Oct 2023 compared to the same period last year. Steel, Coal, and Cement, among the eight core industries, achieved impressive double-digit growth rates of 14.5%, 13.1%, and 12.2% respectively. Additionally, the Index of Industrial Production (IIP) data showed growth in the manufacturing sector at 5.8% and in the mining sector at 9.1% between April and November on a Y-o-Y basis. On the other hand, the service sector has demonstrated strong performance, with a growth rate of 8% year-on-year for the first half of the financial year. Additionally, the PMI index reached a six-month high of 61.8 in January and remained in the expansionary zone throughout the year.

Challenges and Inflation Pressures

On the downside, the Indian economy grappled with a higher inflation rate which was led by rising geo-political tension, soaring fuel & commodity prices and food pricing pressure. To curb this inflationary pressure, RBI has tightened its monetary policy and maintained the repo rate unchanged for the seventh consecutive policy review. Prolonged higher interest rates continued to weigh on household consumption and corporate investment. The agriculture sector is experiencing a deceleration, with a contraction of 0.8% in the October to December 2023 quarter and a modest growth of 0.7% for the full fiscal year which is a key concern for the economy.

However, the government has actively provided support to counter the growing concerns as the Union Budget 2024 allocates `1.27 lakh crore to these (Agriculture and Allied) sectors. Also, ongoing intiatives such as PM-KISAN Yojana, PMKMY and the Interest Subvention Scheme (ISS) are continuously providing support to the farmers and the industry.

Read More: Management Discussion & Analysis FY 2022-23

Outlook

On account of the declining inflation rate, supporting business investment and discretionary household spending, the Indian economy will remain sturdy and showcase robust growth in the coming financial year. According to RBI, the growth rate for FY 2024-25 will stand at 7%. The inflation rate in India is expected to decline in FY 2024-25 to 4.5% from an average of 5.4% during FY 2023-24. Monetary policy easing is assumed to start in the second half of 2024 backed by Government investment will remain at high levels. Moreover, the implementation of government initiatives such as the PLI scheme, the Make in India campaign, and the relaxation of FDI limits is expected to enhance growth.

On the other side, rising geopolitical tension and global slowdown along with supply-chain disruption remains can dent the potential growth. Also, this year, India is holding its general elections, which could have far-reaching effects on economic growth, market stability, and investor confidence. A change in government can influence trade policy, geopolitical relations, and economic policy, thereby altering the economic and industrial outlook. However, the diverse economic base, strong domestic consumption and various government support will help the economy counter the downside risk.