Materiality Assessment in ESG: Key Insights from KFL

Materiality Assessment

Materiality in ESG involves a standardised method for identifying and prioritising significant ESG issues stemming from an organisation’s substantial influence on the economy, environment, and society. KFL has undertaken a materiality assessment to pinpoint issues that significantly affect the Company’s business performance, reputation, and stakeholder interests. This assessment has involved collaboration with both internal and external stakeholders to enhance KFL’s ability to formulate its strategy and allocate efforts, resources, and reporting accordingly to address these material issues.

Methodology

The materiality assessment methodology employed by KFL involved several systematic steps. Initially, a comprehensive inventory of ESG issues pertinent to the Company’s operations were compiled. These issues underwent rigorous evaluation, considering their potential implications on KFL’s growth trajectory, business continuity, brand equity, and establishment of enduring strategic objectives. Furthermore, each ESG issue was meticulously scrutinised in terms of its alignment with risk factors and its efficacy in mitigating business risks. Throughout this process, KFL actively engaged both internal stakeholders (employees, leadership, and senior management) and external stakeholders (including investors, NGOs, customers, and suppliers) to solicit their invaluable insights on the significance of identified ESG concerns. The weightage of stakeholder feedback was calibrated based on their respective influence on KFL’s operational landscape. Subsequently, the finalised list of material issues underwent a stringent evaluation against globally recognised benchmarks such as the United Nations Sustainable Development Goals (UNSDGs), Dow Jones Sustainability Indices (DJSI), and the Global Reporting Initiative (GRI) standards. After this comprehensive assessment, a materiality matrix was mapped, citing all material issues in accordance with their priority to the business, providing a structured framework for strategic decision-making and resource allocation.

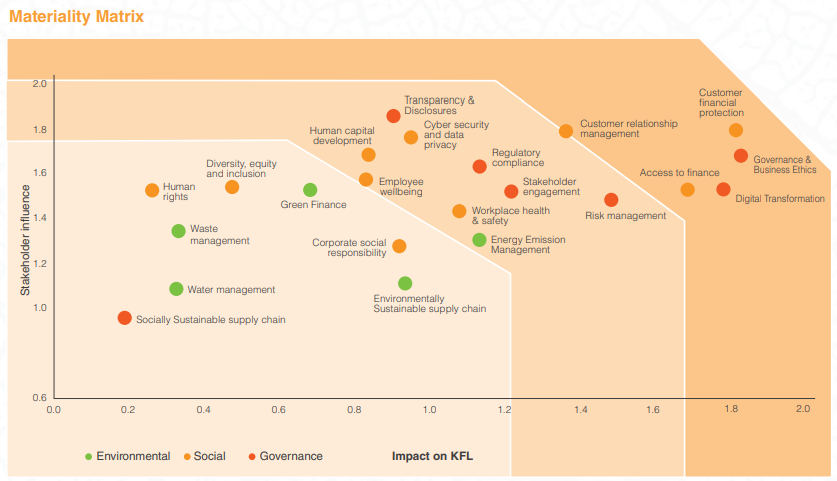

Materiality Matrix

Following the assessment, a materiality matrix was developed to visually depict the significance of each identified issue. This matrix categorises issues into quadrants based on their materiality and impact levels: high materialityhigh impact, high materiality-low impact, low materiality-high impact, and low materiality-low impact. The X-axis represents issues pertinent to KFL, while the Y-axis represents those relevant to stakeholders. Through stakeholder engagement, ratings were collected and used to plot the issues on the matrix. Issues positioned in the upper-right quadrant are deemed high priority, indicating their substantial influence on business performance, necessitating further attention, action, and disclosure. Issues in the lower-left quadrant are considered low priority. Issues falling between the upper-right & lower-left quadrant represent medium priority.

| Material Issue | Current Practice | Linkage with GRI Standard |

| Governance & Business Ethics | KFL has established necessary policies for transparent, efficient operations, guided by a robust governance framework led by the Board of Directors and supported by diverse committees. Sustainability Governance structure has been established, and comprises of Board of Directors, Sustainability Committee, ESG Steering Group and ESG Implementation Team. Code of Conduct and Ethics applicable to all employees and third-party members associated with KFL. | GRI 2: General disclosures 2021 |

| Access To Finance | KFL has developed products (vehicle and MSME lending) to help underserved communities that are low income, self-employed and informally employed. It caters to customers in 8 states and 2 UTs. KFL has a grievance redressal framework where customers can raise product-related concerns and queries. Also, financial literacy infographics are shared regularly in vernacular language for customers. | GRI 203: Indirect economic impacts |

| Customer Financial Protection | KFL has a Privacy Policy for Website Uses that protects user privacy and collects only that data that is lawful and in accordance with the IT Act 2000, IT Rules 2011, and other applicable laws in India. | GRI 418: Customer Privacy 2016 |

| Customer Relationship Management | KFL has a dedicated team that monitors customer complaints and feedback. Employees are trained on communication skills, problem solving and customer service, to deliver exceptional customer service. | GRI 416: Customer Health & Safety 2016 |

| Digital Transformation | KFL has a unique digital lending system based on appropriate risk pricing. It also has an in-house integrated technology & portfolio management system. Digitisation to reduce waste, travel, and carbon footprint. | GRI 305: Emissions 2016 |

| Transparency & Disclosures | Effective corporate governance whose principles are centred on independence, transparency, accountability, responsibility, compliance, ethics and trust. KFL discloses clear information about company policies, procedures and operations allowing stakeholders to access relevant information and understand the organisational objectives. | Complete Set of GRI Standards |

| Regulatory Compliance | KFL upholds a strong corporate governance and compliance ethos. It has established adequate control systems to ensure compliance with the provisions of applicable regulations and adhere to the ethical standards. No penalties have been imposed by the regulator during the financial year ended March 31, 2024. | GRI 2: General Disclosures 2021 |

| Risk Management | KFL has a Risk Management Committee (RMC) in place that reviews the Risk Management Policy. The RMC meets quarterly. KFL integrates ESG criteria into its operations and financing decisions for screening the material ESG risks and opportunities of every product offered. The detailed procedure for management & mitigation of material ESG risks is defined in KFL’s Environmental & Social Management System (ESMS) framework. | GRI 2: General disclosures 2021 |

| Cyber Security & Data Privacy | KFL has an IT Strategy Committee, a Board-approved IT Policy and a Board-level Risk Management Committee in place. Cert-in & ReBIT advisories to protect against cybersecurity threats. An internal team monitors cyber risks. Subscription opted for threat intelligence services. KFL has adopted a Risk-based approach and follows defence-in-depth to protect its information systems against cyber-attacks. IT risk assessment and Vulnerability Assessment & Penetration Testing is being assessed by an independent entity on an annual basis in compliance to the IS audit framework laid down by RBI. Zero incidents of data breaches reported in FY 2024. | GRI 418: Customer Privacy 2016 |

| Stakeholder Engagement | KFL has established an internal Stakeholder Relationship Committee to address stakeholder engagement concerns and insights. There is a Stakeholder Engagement Plan in place. The Company engages with diverse stakeholders – internal (employees), and external (investors, customers, suppliers, communities, media, regulators, and Government) to identify areas of interest, expectations and create long-term value. Dedicated email complaints @kogta.in to lodge stakeholder queries or concerns. | GRI 2: General disclosures 2021 |

| Human Capital Development | KFL conducts multiple online and in-person training sessions to enhance their employees’ overall Learning & Development. ESG awareness programmes are also conducted. Programmes like “Reenergise program” and “Revive-second innings” to boost employee performance. Recognition programmes and incentives in place. Performance management programmes like career development review and performance assessment conducted. The Company is maintaining a talent pool to encourage high performance and upskill employees. | GRI 401: Employment 2016 GRI 404: Training & Education 2016 GRI 405: Diversity & Equal Opportunity 2016 GRI 406: Non-discrimination 2016 |

| Employee Wellbeing | KFL covers all its employees under wellbeing benefits such as health insurance, accident insurance, maternity & paternity benefits, adoption leaves, disability and invalidity coverage, stock ownership, PF, ESIC, gratuity, employee loan, etc. Additionally, the Company offers flexible working arrangements to accommodate employees during various challenging/adverse circumstances. | GRI 403: Occupational Health & Safety 2018 |

| Workplace Health & Safety | KFL has an on-site emergency policy that addresses serious accidents/incidents and an Employee Health and Safety policy that ensures employee health and safety at work. Safety trainings and awareness imparted for all work-related risks; trainings related to fire safety, emergency evacuation drills, first-aid training, road safety, safe driving, etc. are conducted. | GRI 403: Occupational Health & Safety 2018 |

| Energy & Emission Management | KFL has an Environment Policy that aims to adopt energy-saving technologies and equipment across all business operations. | GRI 305: Emissions 2016 |