Ethics & Compliance: Upholding Integrity and Responsibility

Ethics & Compliance

Commitment to Ethical Standard

Kogta Financial India Limited is committed to maintaining the highest standards of ethics and compliance. The Company has established a robust structure to ensure adherence to ethical business conduct and compliance with all applicable laws, rules, and regulations. KFL has implemented various policies, including an Anti-Bribery and Anti-Corruption Policy, to guide all employees, directors, and associated persons in maintaining compliance. Company also conducts training to make employees aware of corrupt practices, trade-based money laundering events, and the mandatory compliance with the Company’s Code of Conduct. The organization also offers training programs for its workforce to identify possible corrupt actions, trade-associated money laundering, and to ensure adherence to the Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines set by RBI.

Vigil Mechanism and Professional Integrity

Furthermore, KFL has a vigil mechanism in place to report unethical behavior, suspected or actual fraud, or violation of the Company’s code of conduct and personnel policies. This mechanism ensures standards of professionalism, honesty, integrity, and ethical behavior, providing adequate safeguards against the victimization of employees who avail of the mechanism. In FY 2023-24, no disciplinary action was taken by any law enforcement agency for charges of bribery/corruption on Directors/KMPs/employees.

Digital Compliance Management

KFL introduced a digital Compliance Management Tool, offering a comprehensive view of compliance status with features like live dashboards for delayed and overdue tasks, a compliance calendar, and proof of compliances. It maps compliances to relevant stakeholders based on criticality, location, and department. The first pilot was launched for the Corporate Office.

Marketing Compliance

As of FY 2023-24, no incidents of non-compliance concerning marketing communications were reported.

Tax Compliance

Robust Tax Compliance System

KFL has a robust system in place for ensuring compliance with tax regulations, monitored and documented through an internally developed tracking system. The organization upholds strict standards through regular internal and external audits, ensuring transparency and adherence to fiscal responsibilities.

Digital Tax Compliance Tracking

Compliance Management Tool includes a digital tax compliance tracker, which has significantly enhanced the company’s capabilities by providing a comprehensive view of any delayed or overdue compliances, maintaining an organized compliance calendar, and tracking both executed and reported compliances. This tool has been instrumental in facilitating the timely payment of taxes and ensuring that all tax deposits are made regularly to the appropriate authorities, reinforcing KFL’s commitment to full compliance and fiscal integrity. By leveraging technology to streamline tax compliance processes, the Company not only strengthens its internal controls but also enhances its overall efficiency and accuracy.

Responsible Lending

ESG Integration in Lending Decisions

KFL incorporates Environmental, Social, and Governance (ESG) criteria into its operational and financing decisions. It conducts ESG due diligence on its product offerings to identify potential ESG risks and ensure compliance with ESG standards. This integration screens for material ESG risks and opportunities during the lending procedure, ensuring sustainability from environmental, social, and financial standpoints. The inclusion of ESG within the Company’s financing decisions commences during due diligence and continues throughout the credit phase. By including ESG considerations in both operational and financing decisions, Kogta Financial India Limited is taking proactive steps to ensure that its activities are aligned with best practices for sustainability and ethical conduct.

Quantitative ESG Assessment and Compliance

Each proposal is subject to a quantitative assessment via an ESG checklist and must achieve a minimum required ESG risk score to move forward. Proposals that fail to meet this threshold gather further high-level screening by senior management. KFL strictly adheres to the prohibited investment activities list of the Asian Development Bank (ADB) and the International Finance Corporation’s (IFC) Performance Standards on Social and Environmental Sustainability, conscientiously refraining from conducting business with any excluded entities.

Mitigation and Monitoring of ESG Risks

Should the screening or diligence process identify substantial risks, the borrower must construct an action plan in consultation with KFL to mitigate these risks or monitor ongoing progress concerning ESG aspects, as necessary.

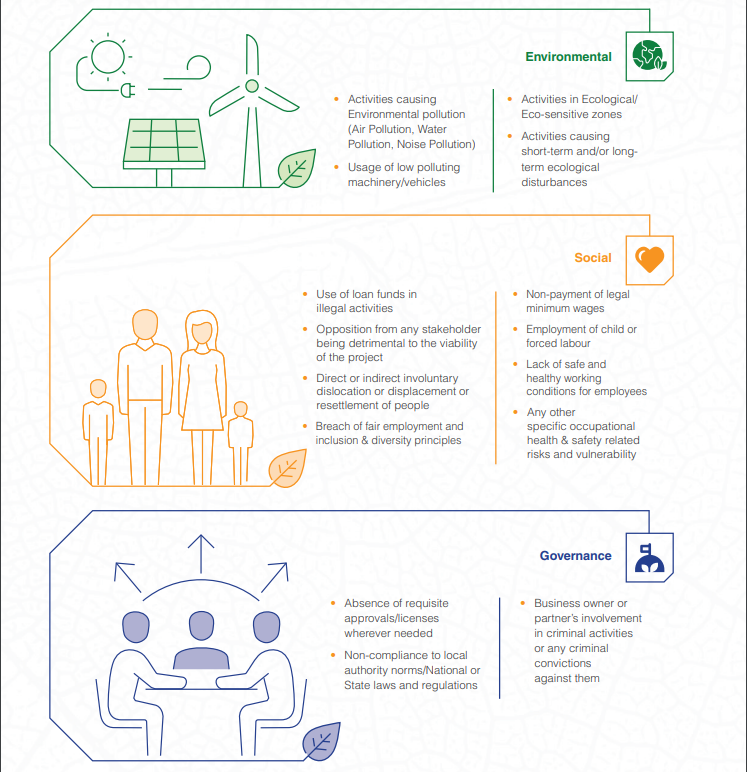

Key concerns that are checked during ESG due diligence include:

The Company also obtains a formal declaration (ESG declaration) from these borrowers and vendors, as an acknowledgement and commitment to meeting its ESG criteria outlined in the ESG policy, throughout the duration of engagement.