- ESG Journey

- Sustainability Policy

- Goals & Commitments

- Responsible Lending

- Sustainability Governance

The process of incorporating ESG into our business and financing decisions began by adopting a board approved ESG Policy. We began our journey of responsible lending through ESG due diligence during the credit phase, a process to ensure ESG compliance and develop action plan for improvement. Our ESG policy ensures that our services and operations are socially and financially sustainable and reflect a shift towards promoting environmental sustainability.

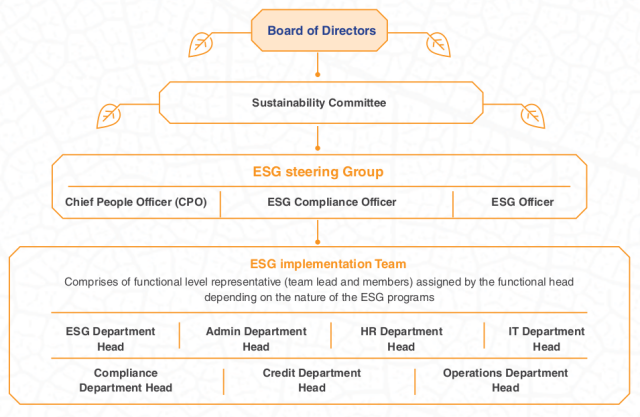

We have a dedicated multi-tier governance framework to effectively integrate and monitor Environmental, Social & Governance (ESG) principles within the company. This sustainability governance structure encompasses the Board of Directors, Sustainability Committee, ESG Steering Group, and ESG Implementation team.

On-site Emergency Policy

Environment Policy

Employee health and safety policy

Waste Management Policy

Stakeholder Engagement Plan

Code Of Responsible Investing

Policy on Prohibited Activities

Procurement Policy

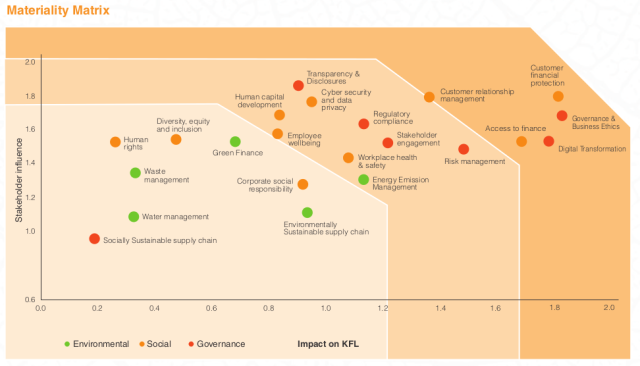

Kogta Financial (India) Limited (KFL) is committed to function as a responsible business, with an aim to fully align with and contribute to good Environmental, Social and Governance (ESG) practices. We have applied the principles of materiality in assessing the issues, opportunities and challenges that have a material impact on our business, and our ability to deliver sustained value to our shareholders and key stakeholders. Materiality assessment allows us to recalibrate our strategy and serves as an opportunity to address emerging risks and leverage opportunities to future-proof our business.

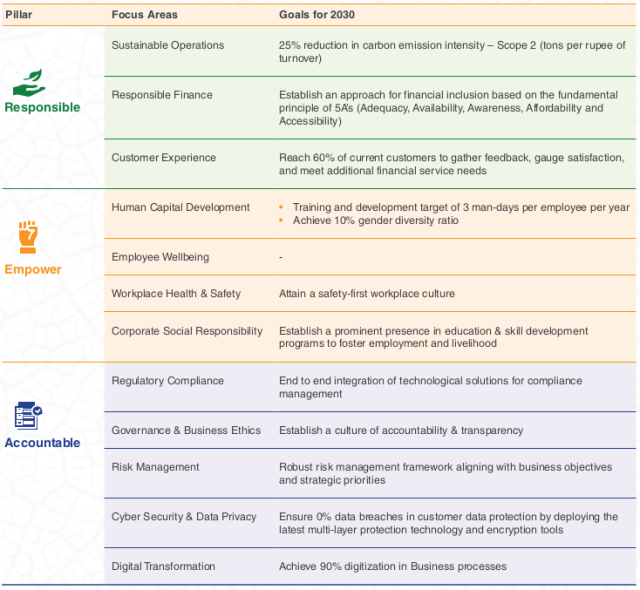

KFL’s sustainability strategy is structured around three fundamental pillars i.e., Responsible, Empower & Accountable. These pillars are further divided into twelve focus areas encompassing ESG aspects. KFL has established goals for 2030 within each focus area and has crafted a roadmap to guide its endeavors toward achieving these objectives. The company is committed to monitoring its progress against these targets and disclose its performance publicly, providing stakeholders with transparent insights into its sustainability efforts.

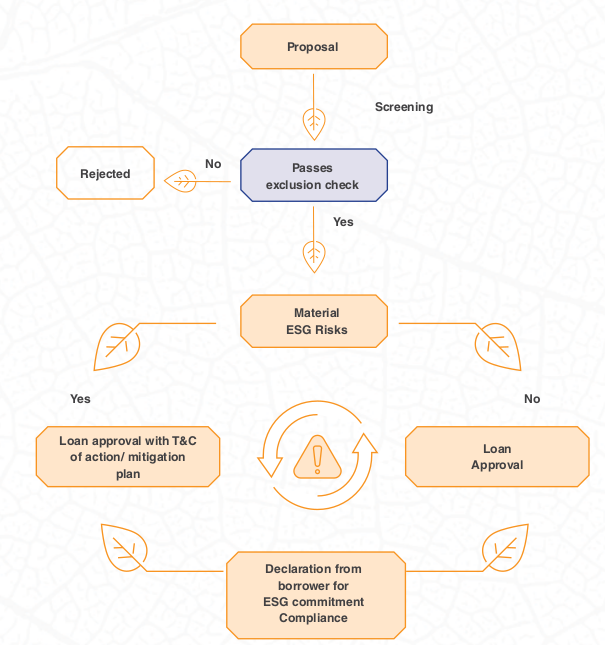

KFL integrates ESG criteria into its operations and financing decisions for screening the material ESG risks and Opportunities of every product offered. This ensures that our services and operations are sustainable from an environmental, social, and financial perspective. The integration of ESG into our financing decisions starts from due diligence through the credit phase.

Our products are subject to ESG due diligence, which involves screening for potential ESG risks and ensuring ESG compliance. Each proposal undergoes a quantitative assessment through an ESG checklist and has to achieve a minimum ESG risk score to proceed further. Proposals not meeting the minimum required ESG risk score go through another high-level screening by senior management. KFL adheres to the ADB (Asian Development Bank) prohibited investment activities list and the IFC (International Finance Corporation) Performance Standards on Social & Environmental Sustainability and strictly avoids doing business with any excluded entity. During the screening or diligence process, if material risks are identified, the borrower must develop an action plan to mitigate these risks or monitor ongoing progress on ESG aspects, as appropriate. We also obtain a declaration from our borrowers and vendors confirming compliance with our transparent and non-discriminatory ESG commitments outlined in our ESG policy.